Programmatic in Spain & Portugal

- Author: Irina Rubanenko

Portugal and Spain are among the most digitally advanced countries in Western Europe. Here are the main features and programmatic peculiarities of these countries.

Digital Ad Market

The Statista Digital Market Outlook estimates that spending on digital ads in Spain will increase to around US$4.5 billion in 2022. Moreover, forecasts demonstrate that advertisers will allocate nearly 60% of their budgets towards mobile ad campaigns by 2025.

In Portugal ad spending in the Digital Advertising market is projected to reach US$718m in 2022. According to Statista, 95% of the Digital Advertising revenue will be generated through programmatic advertising in 2026.

Available Audience

There were 43.93 million internet users in Spain in 2022 and stood at 94% of the total population. Kepios analysis indicates that internet users in Spain increased by 355 thousand (+0.8%) between 2021 and 2022.

Data from GSMA Intelligence shows that there were 55.52 million cellular mobile connections in Spain at the start of this year and increased by 551 thousand (+1%) between 2021 and 2022.

As for Portugal, there were 8.63 million internet users in 2022. And the internet penetration rate stood at 85% percent of the total population. According to Kepios analysis, internet users in Portugal increased by 245 thousand (+2.9%) between 2021 and 2022.

Data from GSMA Intelligence shows that there were 16.07 million cellular mobile connections in Portugal at the start of 2022 and increased by 303 thousand (+1.9%).

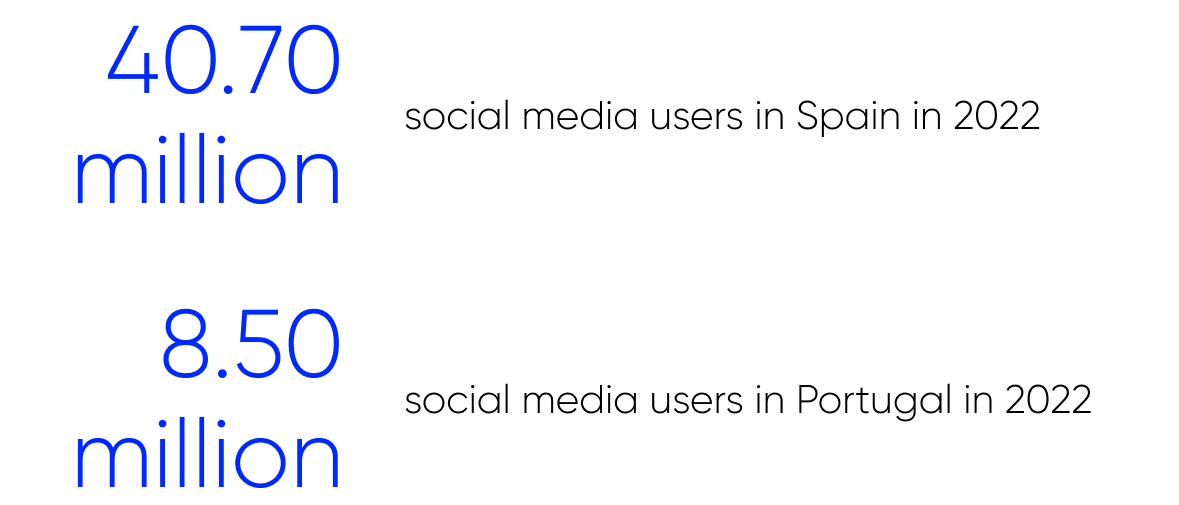

Also worth noting the popularity of social media in Spain and Portugal.

The most popular social networks in Spain and Portugal are YouTube, Instagram, Facebook, TikTok, LinkedIn and Twitter.

Ad Formats

According to Statista, in Spain the largest segment with a market volume of US$1.7B is banner and in Portugal is Search Advertising with a market volume of US$325m in 2022.

Another interesting trend that can be observed in these countries as well as numerous other digitally developed markets is the increased focus on social media. Spain and Portugal have a social network penetration rate of around 86%, and with more people using such platforms for news, entertainment, and communication each day, it comes as no surprise that spending on social media advertising is ramping up nonstop.

Ad Inventory

Top Websites Ranking in Spain

- google.com, youtube.com, facebook.com, google.es, marca.com, amazon.es, wikipedia.org, as.com, elmundo.es, elpais.com, live.com.

Top Websites Ranking in Portugal

- google.com, youtube.com, sapo.pt, google.pt, wikipedia.org, abola.pt, noticiasaominuto.com

Top SSPs used in Portugal and Spain

- Google Ad Manager

- AppNexus

- Rubicon Project

- Pubmatic

- Indexexchange

- Spotx

- Smart AdServer

- Sovrn

- Adform Publisher Edge

- Adtech

- Openx.com

E-commerce in Spain and Portugal

Spain is the 13th largest e-commerce market with a revenue of US$27 billion in 2021, placing it ahead of Italy and behind Russia. Consumer behavior is changed by COVID-19. The number of consumers who plan to shop online for most categories is up to 120%.

More than five of every ten inhabitants in Portugal were estimated to make online purchases in 2021. The COVID-19 pandemic played a big part in appealing consumers to buying on the internet. Portugal is the 45th largest market for eCommerce with a revenue of US$4 billion in 2021.

Revenues for eCommerce continue to increase. New markets are emerging, and existing markets also have the potential for further development. Global growth will continue over the next few years.

Top-5 ecommerce categories are in Spain and Portugal

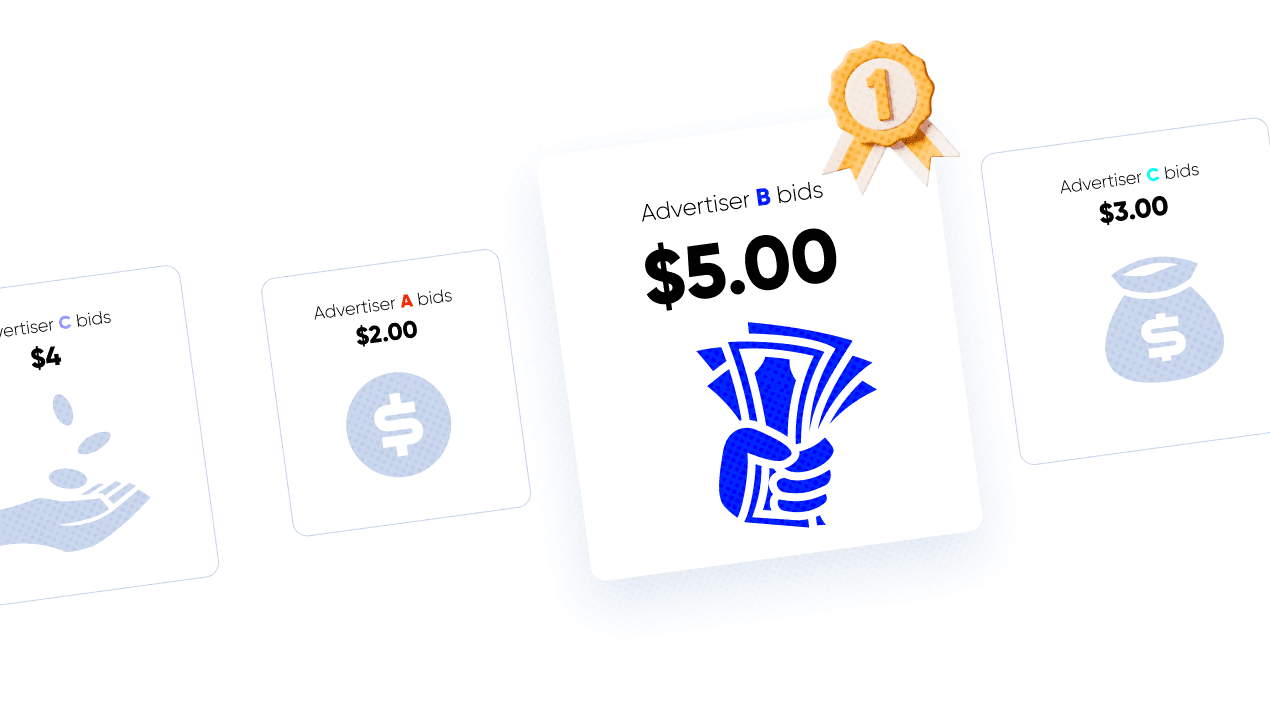

Market Peculiarities

Spain’s and Portugal’s advertising landscape is undergoing a fundamental digital transformation. Parallel to rising internet penetration rates and the ever-expanding demand for online media content, a lot of companies now focus on digital ad campaigns and invest more heavily in online marketing activities than ever before.

With regard to programmatic advertising, it has become a necessary instrument for Spanish and Portuguese brands that desire to have more control of their digital advertising strategies and outcomes.

Read also

Read also