Programmatic in the Philippines

- Author: Vera Finaeva

The Philippines have one of the youngest digital markets in the world. Despite the fact its programmatic adoption is quite low, experts estimate the steady growth of programmatic spend in the near future.

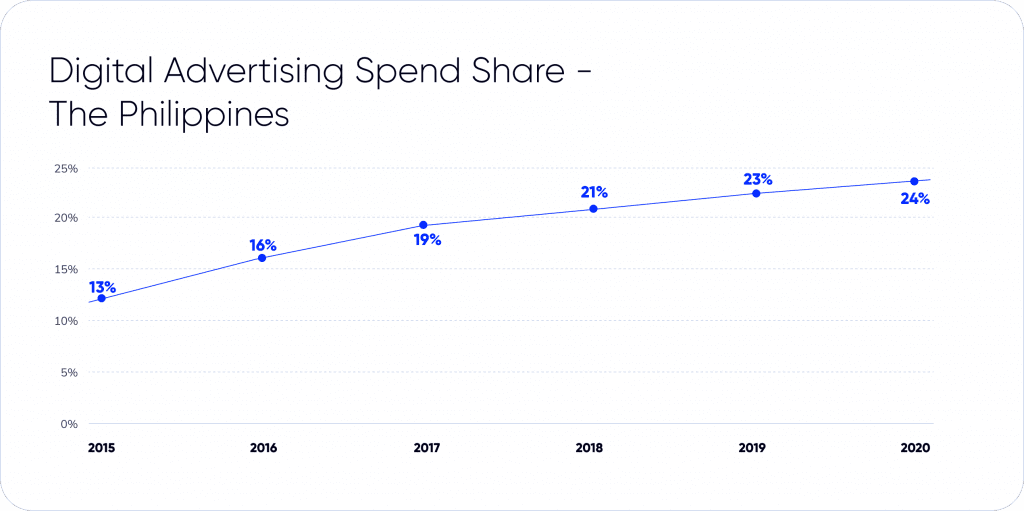

Digital Ad market

In the Philippines, total digital advertising expenditure amounted to $603 million in 2019 and is expected to reach $638 million by the end of 2020.

According to Statista Report

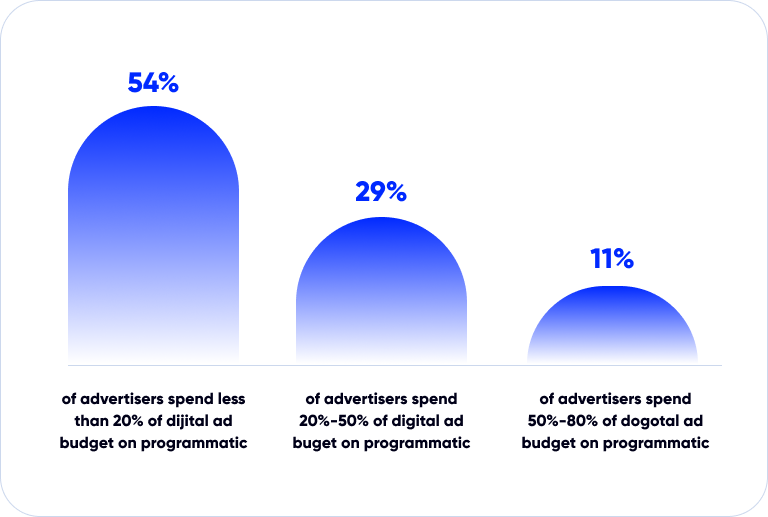

Programmatic advertising expenditure has notably increased from $2 million in 2015 to $7 million in 2019. Nowadays the share of programmatic advertising has amounted to 15%. Nevertheless, there is a huge opportunity for programmatic growth in the Philippines. It is predicted that programmatic share will increase by nearly 50% during the next two years.

According to Rubicon Project

According to the forecast, 82% of media buyers predict that the digital budget allocated to programmatic will increase, and only 18% of them expect it to remain unchanged in the next year.

Available audience

Reach: 55.12 million cookies

Impressions: 9.24 billion

Ad Formats

Most of the digital advertising budget is allocated to mobile ad formats. In the Philippines 94% of Internet users have mobile phones, 67% of them have desktop or laptop and 40% own a tablet. In 2019, mobile share of the entire digital ad spending increased from 12% in 2015 to 57.5% in 2019. According to the statistics, mobile share is expected to reach 60% by the end of 2020. Moreover, the Philippine advertisers will invest more in the mobile app inventory.

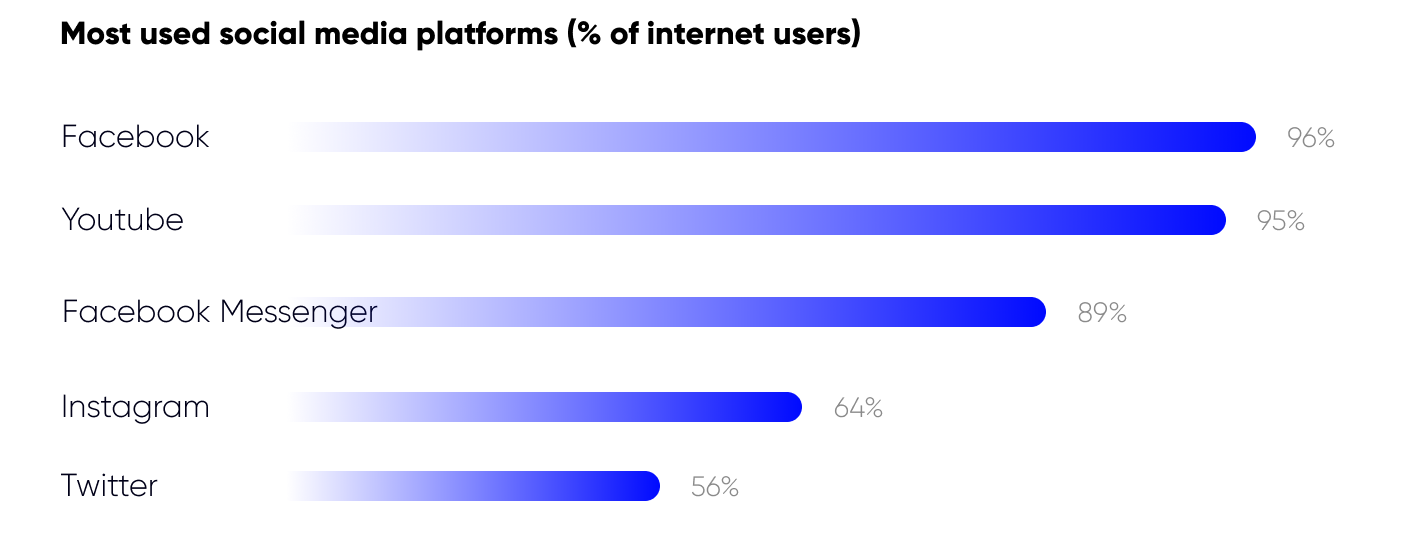

In the Philippines almost seven out of ten of Internet users have social networks and the majority of them, which is nearly 98%, access it via mobile. Facebook demonstrates the highest figure of the advertising reach – 71%, followed by Instagram and LinkedIn. The advertising reach amounts to 14% and 12% respectively. Moreover, half of the Internet users discover new brands from social media.

According to Date Reportal

Video ad formats dominate in the Philippine digital advertising market. Statistics shows that the most popular online content activities are watching online videos (98%) and vlogs (80%). In 2019 digital video spend amounted to $49 million with its 14% of year-on-year change.

Speaking of programmatic advertising, in the next year Filipino media buyers will mostly invest in:

- Display mobile

- In-stream video

- Display mobile app

- Display desktop

- Out-stream video

Viewability and Ad Fraud

In 2020 viewability rate of display ads has amounted to 64%, which is higher than the APAC average of 59%. Nevertheless, video viewability has only reached 62% compared to the average of 66%.

The Philippines shows one of the lowest rates within ad fraud in the APAC region. In 2020 the percentage has reached only 0.6% compared to the APAC average of 0.9%.

Ad Inventory

Top Websites Ranking:

facebook.com, google.com, youtube.com, twitter.com, yahoo.com, messenger.com, shopee.ph, instagram.com, google.com.ph, lazada.com.ph

Top SSPs used in the Philippines:

- SpotX

- PubMatic

- OpenX

- Criteo

- Smaato

Top DSPs used in the Philippines:

- Google Display & Video 360

- AppNexus

- The Trade Desk

- Turn

Market Peculiarities

Due to the pervasiveness of English, the Philippine digital advertising market consumes more foreign media. That’s why it tends to be the biggest source of inventory.

Read also

Read also