Programmatic in Indonesia

- Author: Lizaveta Zhuk

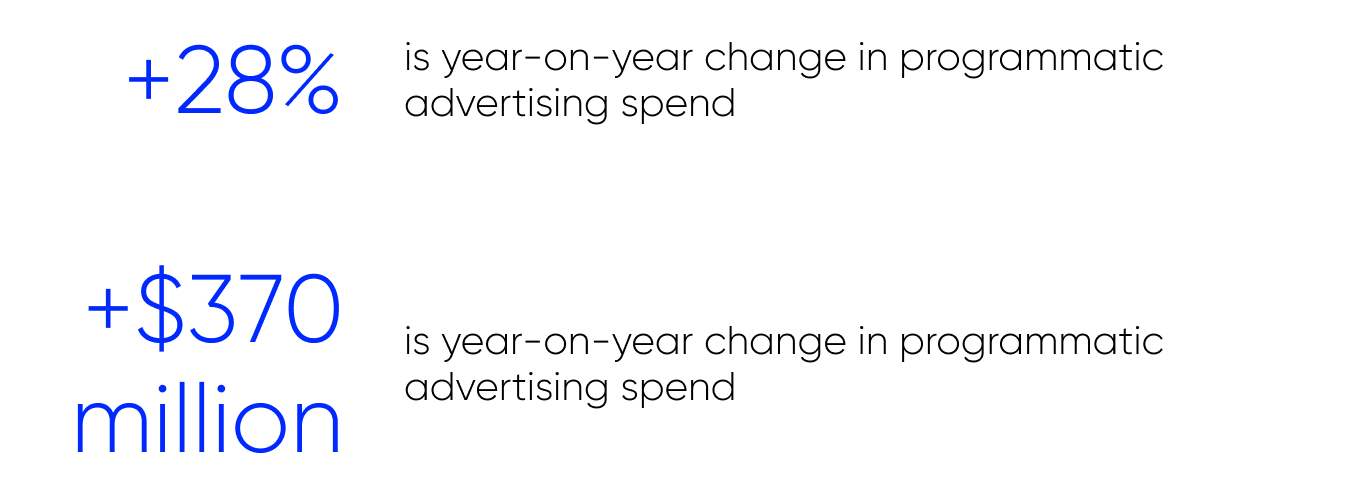

The digital advertising market in Indonesia is continuing to grow rapidly. In terms of programmatic advertising, a steadily-expanding category in adtech, the Indonesian market also performed extremely well and growth is in line with global trends.

Digital ad market

Hailed by advertisers for its potential to streamline the process of ad buying, programmatic advertising is set to dominate the Southeast Asian digital advertising sector. Thanks to its effectiveness, efficiency and control it lends to marketers, Indonesia has witnessed substantial growth in programmatic spending in recent years – a trend which is projected to continue into the near future.

Meanwhile, programmatic ads share 79.7% of total digital advertising spending in February of 2022. Brands in Indonesia increase their spending on programmatic ads annually. They spent $1.69 billion on programmatic between 2021 and 2022.

Indonesia also experienced rapid growth in terms of mobile programmatic, and it is estimated that mobile ad spending will grow to $692 million here by 2023.

Available audience

Indonesia also experienced rapid growth in terms of mobile programmatic, and it is estimated that mobile ad spending will grow to $692 million here by 2023.

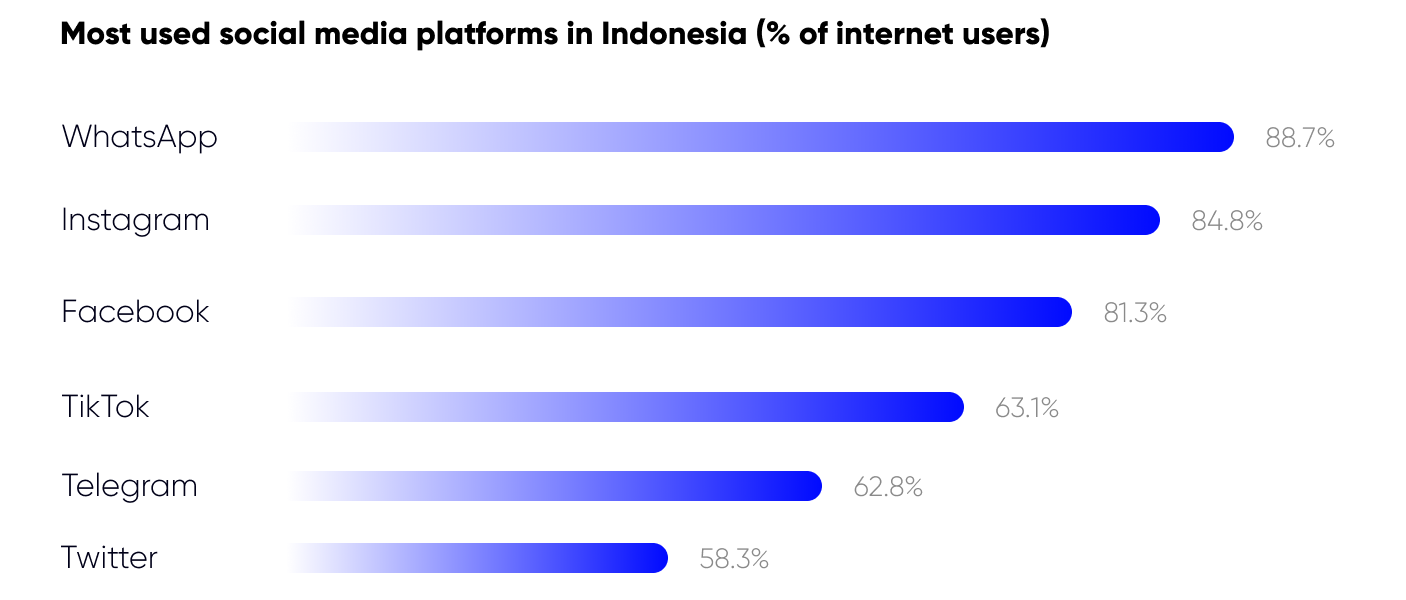

With 191.4 million active social networks users, Indonesia ranked third among the countries with the highest number of social media users worldwide. Moreover, it continues to grow. According to DataReportal, social media users increased by 21 million (+12.6%) between 2021 and 2022.

Source: DataReportal

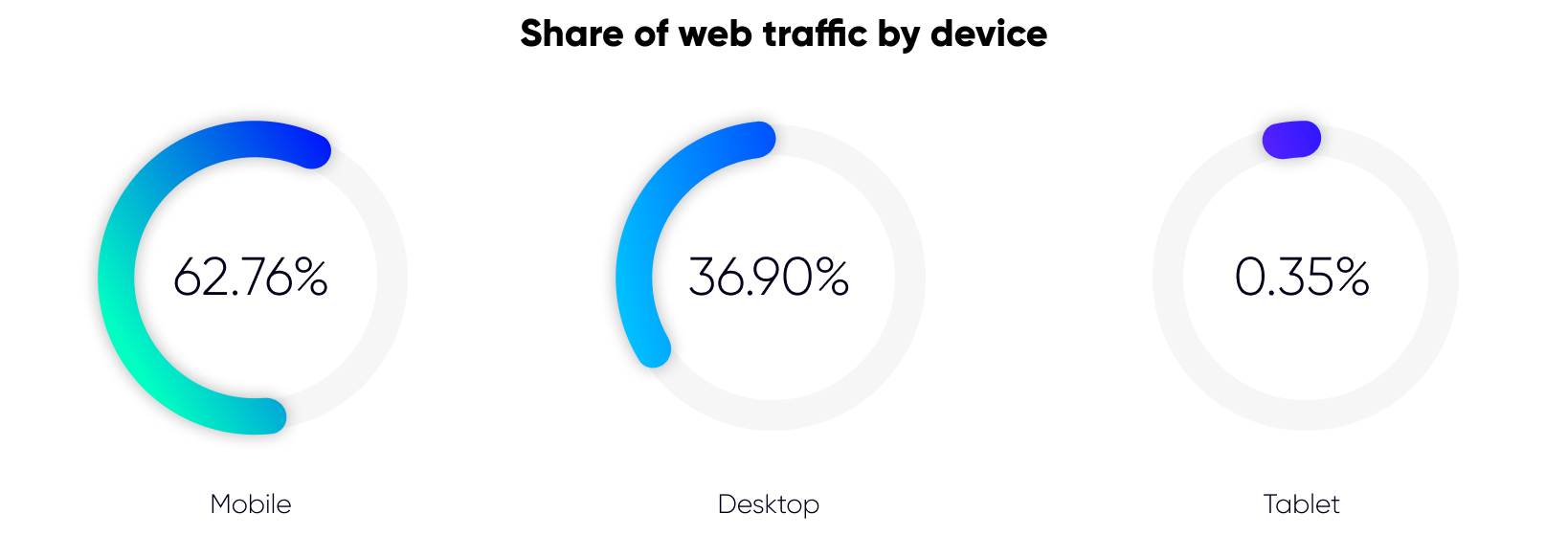

Smartphones aren’t a new phenomenon in Indonesia and this market has always been mobile-first. That’s why the penetration of mobile devices has reached a high level. There are 94.1% of smartphone users in Indonesia.

Source: DataReportal

Ad formats

The market’s largest segment is banner advertising with a market volume of $977.5m in 2022.

Another developing tendency among Indonesian brands is to focus on mobile devices because of the high number of smartphone users in this country. According to PubMatic research, 79% of brands are investing in in-app video advertising for brand alignment in Indonesia versus an APAC average of 72%.

Advertising on social networks is popular as well. The annual spend on social media ads is $899.4 in Indonesia. Considering raising social media users in Indonesia, brands redistribute their ad budgets to social media. Thus we observed increasing spending on social media ads by 23.6% between 2021 and 2022.

Inventory

Top websites ranking

Google.com, Okezone.com, Youtube.com, Pikiran-rakyat.com, Tribunnews.com, Liputan6.com, Kumparan.com, Merdeka.com, Kompas.com, Detik.com, Suara.com, Grid.id, Facebook.com, Sindonews.com, Jawapos.com

Top SSPs used in Indonesia

- Аppnexus

- InMobi

- OpenX

- PubMatic

- Rubicon Project

- IronSource

- Vserv.mobi

- AdColony

- Unity Ads

- AdLabs

E-commerce market in Indonesia

Indonesia is the largest e-commerce market in the world. As many as 90% of internet users in the country have purchased products or services online. Indonesia’s e-commerce market is expected to grow by 23.8% in 2022 and reach $30 billion in 2022 as projection GlobalData shows.

According to GlobalData, e-commerce will grow by 22.0% annually between 2021 and 2025 to reach $53.8 billion in 2025. It is supported by increasing internet and smartphone penetration, and a proliferation of online marketplace and payment tools. Moreover, the COVID-19 pandemic made online shopping more appealing among users.

As the proliferation of new technologies continues and consumer sentiments evolve about online shopping, brands should track their target audience and optimize their strategy. The first thing brands should consider is that mobile devices are the main source of online shopping in Indonesia. According to the International Traid Administration, 75% of online shoppers in Indonesia made online purchases through smartphones rather than desktops or laptops.

Source: DataReportal

The growth of mobile internet connections and the affordability of smartphones, among other factors, have driven higher social media usage in Indonesia. For most Indonesians, social networks have been a tool to communicate and interact with brands. It is a second thing that brands should consider to optimize their strategy. In fact, social media is the main channel for online brand research for 61.1% of Indonesian internet users. Also, social media ads are a source of new brand discovery for 35.7% of Indonesians.

So, consumers may be influenced by the ads they see on social media or in mobile apps or sites and could be motivated to make purchases. That’s why brands could use social networks and mobile ads as a complementary component of their advertising strategy to scale its effectiveness.

Market peculiarities

The spreading of programmatic advertising isn’t slowing down. With the development of Artificial Intelligence and Machine Learning, it is now becoming a fast-growing advertising tendency in the Asia Pacific region as well.

The Indonesian advertising market has undergone a digital transformation throughout the past few decades. As such, brands have turned their attention to programmatic advertising. Lack of knowledge about programmatic advertising processes is the single biggest barrier to programmatic adoption in Indonesia. However, it is expected that there will be an even greater focus on programmatic than other forms of advertising in 2022.

Thus, the programming landscape in Indonesia has become competitive with other countries and has great potential for development and growth.

Read also