Programmatic in Australia

- Author: Vera Finaeva

Australia has already introduced itself as one of the global leaders in programmatic advertising and has a really strong potential for its further expansion. In recent years, increasingly more Australian advertisers have embraced programmatic buying to launch their campaigns in a rapidly moving landscape.

Digital Ad Market

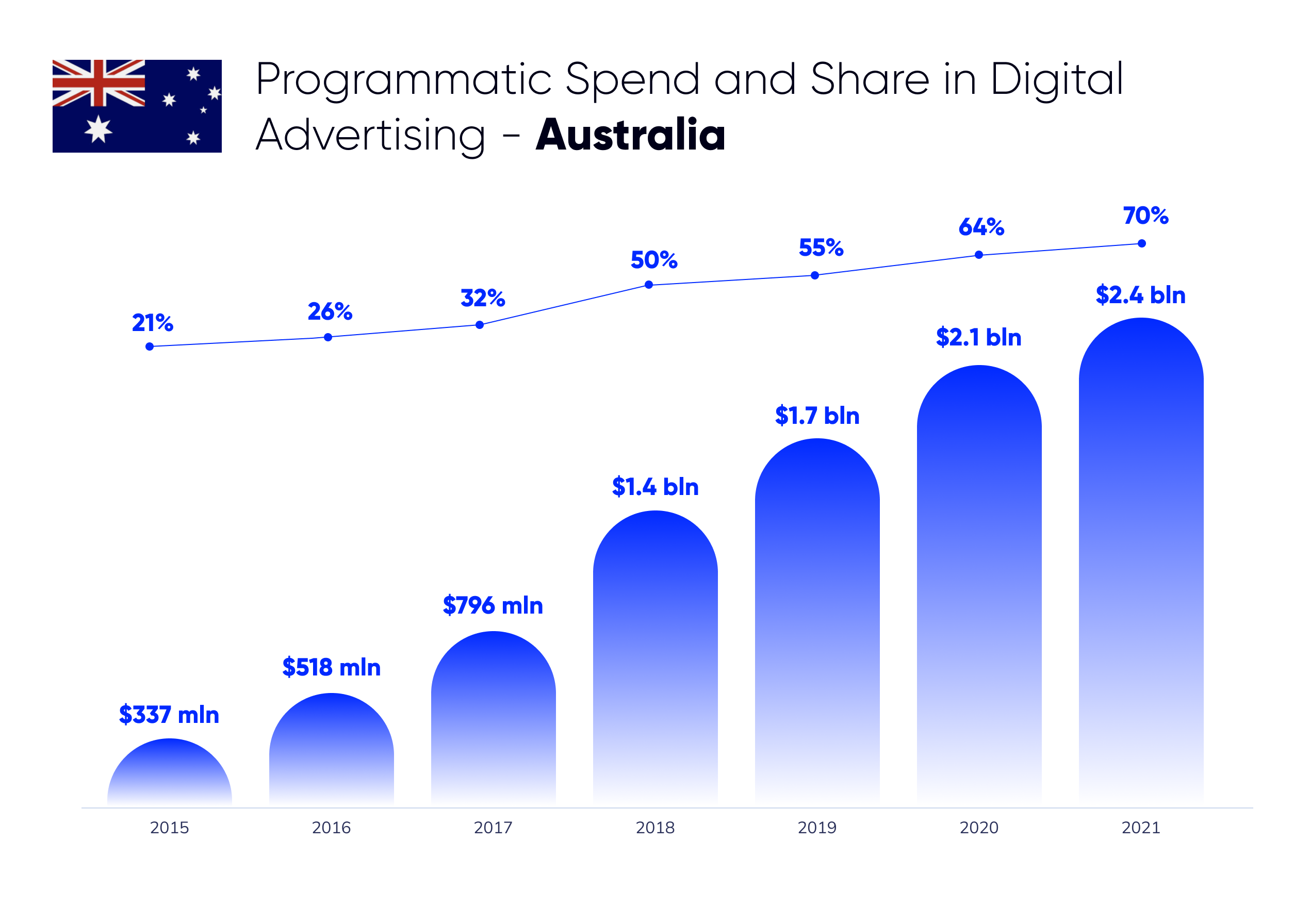

Australian digital advertising spending is estimated to reach $7.5 billion by the end of 2020. Over the past years Australia has shown an exponential growth in programmatic advertising. According to statistics, programmatic expenditure has increased from $337 million in 2015 to $1.7 billion in 2019. It is estimated that programmatic spending will reach $2.1 billion in 2020, representing nearly a 67% increase in the past two years. Nowadays, more than half of the entire digital media is trading programmatically. It is expected that programmatic share will reach 70% by the end of 2021.

According to Zenith Report

Available Audience

Reach: 42.06 million

Impressions: 17.62 billion

Ad Formats

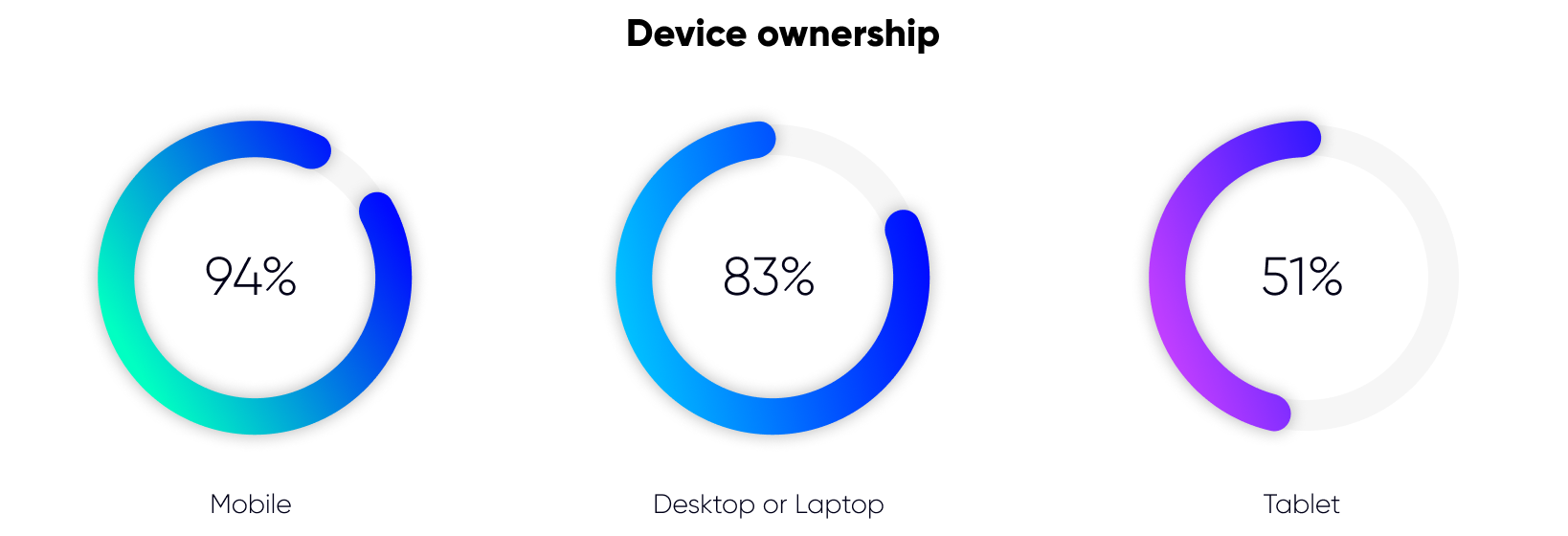

Mobile advertising formats take the lead in the Australian digital advertising market. In 2020 mobile ad spend has exceeded $5 billion. Moreover, 98% of social media users access via mobile.

According to Date Reportal

In Australia, the most common online activities among Internet users are watching online videos (88%), listening to music streaming services (58%), and online radio stations (32%). Video ad formats are holding strong in Australian digital advertising. The share of programmatic video witnessed a huge shift from 26% in 2015 to 55% in 2019. Nowadays Australia is the fifth largest market in the world in terms of programmatic video. According to the IAB Report, by the end of 2020 programmatic video ad spending is estimated to grow by 29% and reach $1.1 billion.

Audio ad formats are also gaining popularity. During 2020, more than half of media buyers have been implementing programmatic audio. Nearly 75% of Australian digital advertisers are starting to embrace podcasts. Nevertheless, programmatic podcasting is still evolving compared to display advertising and has sophistication in attribution and reporting.

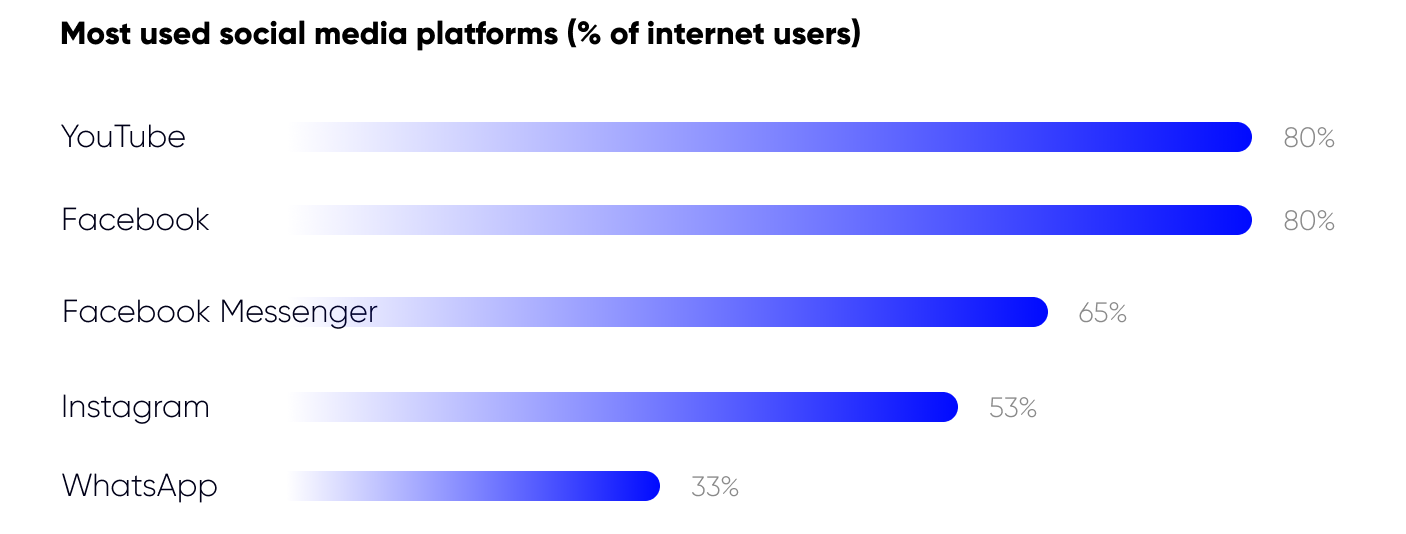

On the subject of social media, seven out of ten people are active social networks users. According to statistics, Facebook reported the highest percent of advertising reach at 71%, followed by LinkedIn (56%) and Instagram (46%).

According to Date Reportal

Viewability and Brand Safety

Australia has one of the best performing markets of media advertising quality. Viewability rates have improved across all formats and platforms in comparison with previous years. In 2019 viewability of desktop ads amounted to 71.8% and video ads to 75.5%. In terms of mobile advertising, viewability rates also showed progressive performance and reached 70.9% in the second half of 2019 compared to 64% in later 2018. Mobile app viewability rate stood at 70% and even outperformed the global average of 68.7%.

Australia shows notable improvements within brand safety. In terms of desktop ads, brand risk level has considerably decreased from 4.6% in the second half of 2018 to 1.9% in the second half of 2019. In terms of mobile brand, risk level has declined by 4.5% and reached 4.2% in the second half of 2019.

Ad Inventory

Top Website Ranking

google.com, youtube.com, facebook.com, google.com.au, instagram.com, twitter.com, ebay.com.au, live.com, wikipedia.org, abc.net.au

Top SSPs used in Australia:

- OpenX

- Rubicon Project

- PubMatic

- Index Exchange

- AppNexus

- Telaria

Top DSPs used in Australia:

- Google Display & Video 360

- The Trade Desk

- MediaMath

- AppNexus

- Adobe DSP

- DataXu

- Turn

- TubeMogul

Market Peculiarities

- Despite the fact open auction is the main type of programmatic buying, private marketplaces have recently seen a substantial growth due to increased demand for premium inventory and advanced technologies on the supply side.

- It is estimated that the implementation of 5G will be the main driver of further programmatic development. That includes the improvement of online user experience and the growth of ad format variety and availability.

Read also

Read also