Marketing for finance: how to improve advertising strategies and achieve success

- Author: Lizaveta Zhuk

Over the past year, people have been looking for more than just financial products — they’ve been searching for ways to better themselves and improve their quality of life. Moreover, the way of discovery is changing. Big time. For financial businesses this means that if you want to capture your target audience’s attention, you need to meet them at their hangout spot and get to know consumers’ viewing habits.

Take a look at these new financial customer behavior trends you might be missing and how you can improve your ad strategy according to them before you start crafting your next campaign.

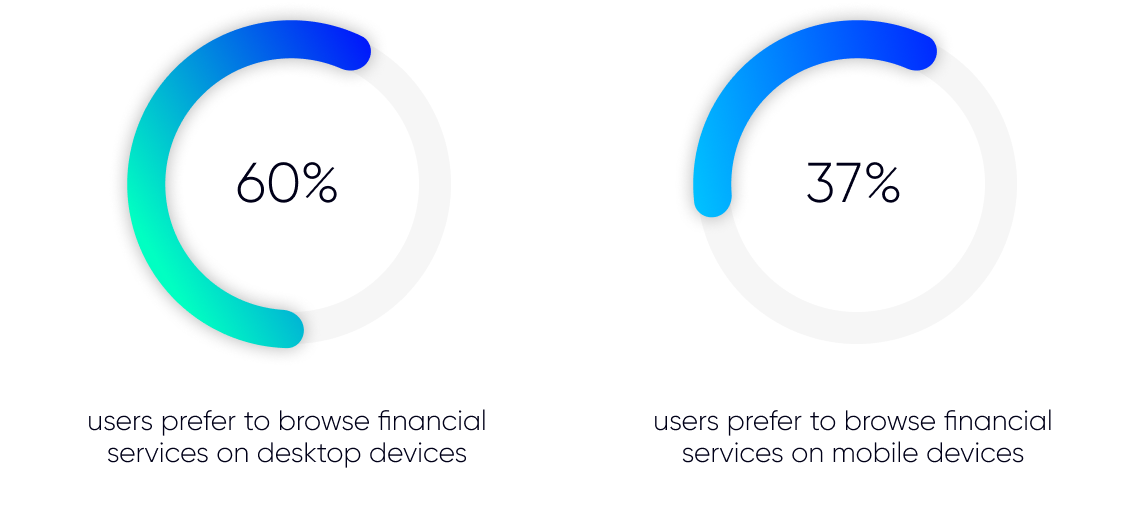

Users prefer big screens

Surprisingly, it’s true. Although there is a global tendency of switching on mobile devices and mobile banking are still on the trend, users who look for financial services more often use desktop devices than mobile phones.

How to lean into this tendency

It may be a bit confusing for your marketing strategy but it’s important to consider. However, it’s time to think more comprehensively and create multi-device ad strategies that reach both mobile and desktop instead of focusing on mobile only. A simpler and more familiar way to reach multi-device audiences is to implement cross-device targeting into your ad strategy.

Cross-device targeting is a practice of displaying ads to the same users across their devices — smartphones, tablets, laptops, desktops and so on. Using different methods and cross-device tracking, algorithms try to confirm if multiple devices all belong to the same users and serve ads to them when they are using one of the devices.

Most consumers of financial services are returning users

According to research, 59% of visits to financial service sites are by users who had previously visited a site compared with 41% of new users.

A new client is always great, so unsurprisingly, a lot of digital agencies are spending energy and money on attracting new clients, even though it requires a lot of resources. However, it’s time to remember how essential it is for businesses to retain existing customers. Likewise, it will be cheaper than attracting a new one — according to research, the cost of acquiring new customers may cost as much as five times more than retaining.

How to lean into this tendency

Obviously, it’s definitely worth thinking about updating media strategy and including tools that will help to increase LTV of brands’ clients. One of such tools is retargeting. It will help to interact with users who have visited a business’s site and left without making a purchase. That way users are reminded of completing actions and not leaving abandoned carts.

Also, brands may use targeting based on CRM data to re-engage existing customers and offer them additional services and products or just remind them about brand services, products, discounts and so on.

In spite of all these tools, it’s crucial to remember that advertising is not about what you sell to customers, it’s about the gap your product or service offers to fill. So try to help users and provide value for money, for example; offering them a free delivery. This fosters loyalty securing that customer in the long run, which allows you a higher likelihood of building lasting relationships with your consumers.

More than half of financial websites visitors leave after viewing one page

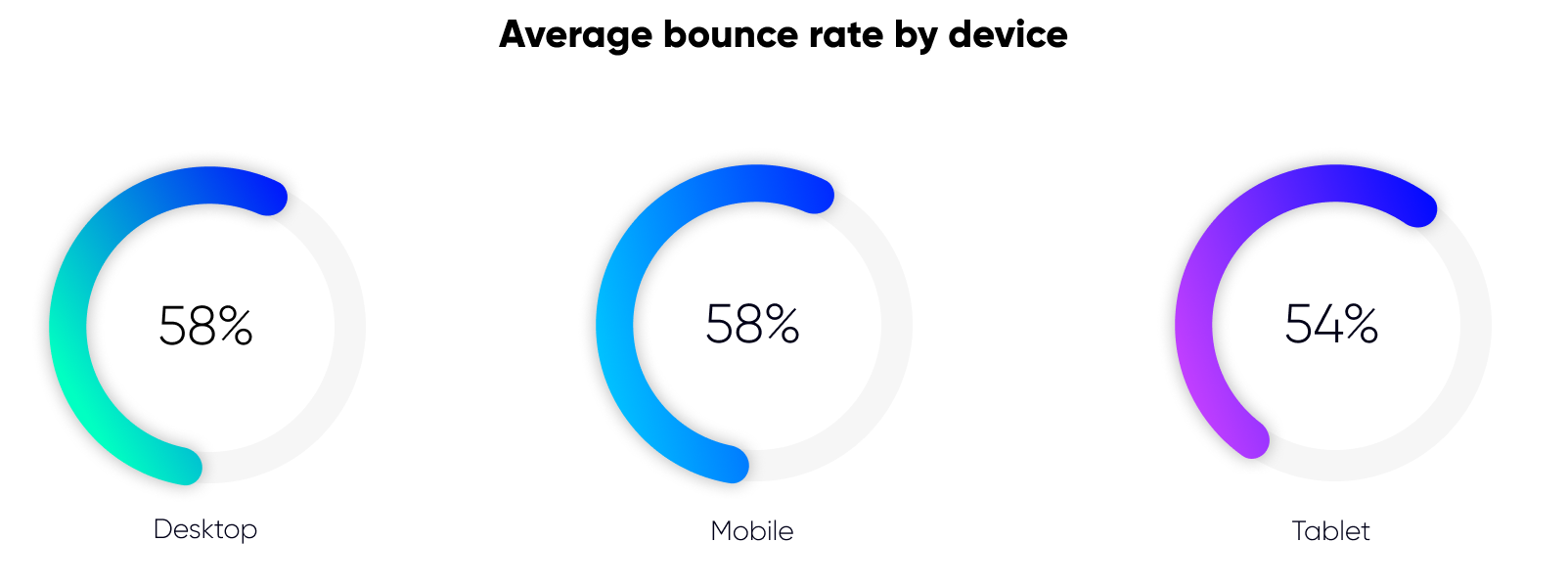

Based on research, 58% of users who visited financial service websites abandoned their journey after viewing just one page. It has a little difference depending on devices but it’s still high. Moreover, it’s even higher than the average bounce rate across all industries being 50%.

How to lean into this tendency

Usually, bounce rate is considered as a very subjective metric but it’s still a good point to think about. If we speak about advertising, let’s begin with users. It’s a good idea to make sure that the target audience is defined correctly. If users who are not interested in a brand’s services follow the website link, then such website visitors may easily and quickly leave the site — it’s not a surprise as financial services aren’t their cup of tea. All in all, it promotes a rise in bounce rate. That is why defining a target audience before running an ad campaign is a crucial step. In order to learn more on how to define the target audience, you may read our article here.

Also, financial services brands should spend more time understanding their potential clients before launching ad campaigns to reduce the likelihood of them leaving the site. A good place to start is a landing page. It shouldn’t be over complicated and difficult to understand as well as it shouldn’t include irrelevant information about the brands’ services and products. It would be better to provide relevant and necessary information in a clear way for users.

Financial service has a low conversion rate

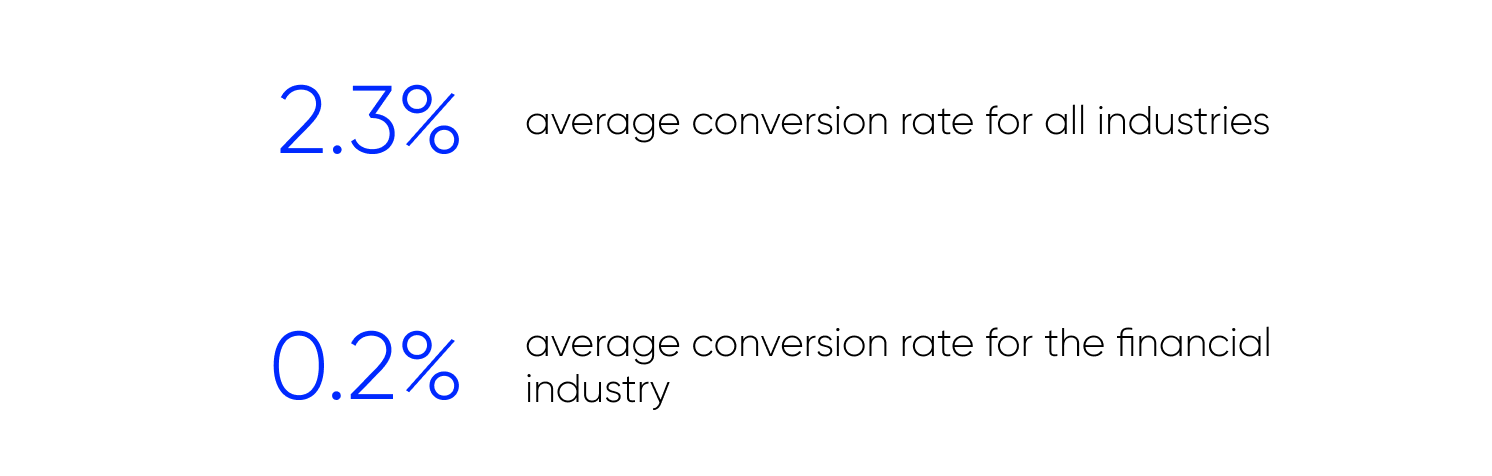

When users search for tools and insights to help them achieve their goal or solve their problems, they might visit different sources and websites. They may follow the advertisement and complete a conversion if they find what they need. Depending on products and how long the buying circle, conversion rate may be different. However, the financial service industry has a lower average conversion rate across all industries.

Source: contentsquare

How to lean into this tendency

Over the past years, users search for more than just products — they look for ways to improve the quality of life, solve problems and feel a bit happier. In order to get conversions, advertising should be about more than just selling goods — it must relieve pain points and provide customers with a solution that they trust. In this way the importance of all parts of the ad campaign is increased: brands need to be near with their target audience across their customer journey at the right place and time, provide accurate and relevant information, and choose the most efficient ad channel etc.

Concerning ad creatives, they need to resonate with a brand’s target audience. When users think about their finances, they don’t speak about how much money they have in their wallets. Banking is not seen as a product, but rather as a role player in important life moments, such as marriage, school, or buying a new home. These milestones and goals are all moments of intent. Show in ad creatives how a target audience can achieve their life goals through the use of a brand’s products and services. That way ad creatives will be more relevant and get higher CTR. In order to improve ad creatives much more, you may read this white paper.

However, it isn’t enough just to improve ad creatives. It’s important to interact with users through the entire customer journey on the right channels and at the right moments when they are ready to purchase. Programmatic is the best solution for achieving that. The technology is based on artificial intelligence and machine learning algorithms that analyze a lot of data in real time to find a brand’s target audience in a large digital world, show them relevant ad messages based on their interest and behavior on the right channels and at the right moments. With programmatic it is easy to target even specific audiences due to improved targeting and build a full customer journey — from first touch and awareness to purchase and loyalty. In the end, it helps significantly increase conversion rates and profit.

NT Technology has been developing programmatic technology for more than 10 years. We have mastered all the intricacies and nuances of programmatic and created our own platform — NT DSP. We will help you to achieve your marketing goals and deliver results that you need. You can be sure of the efficiency of our solution based on the case study below.

How to increase applications for a credit card and decrease Cost Per Lead with programmatic

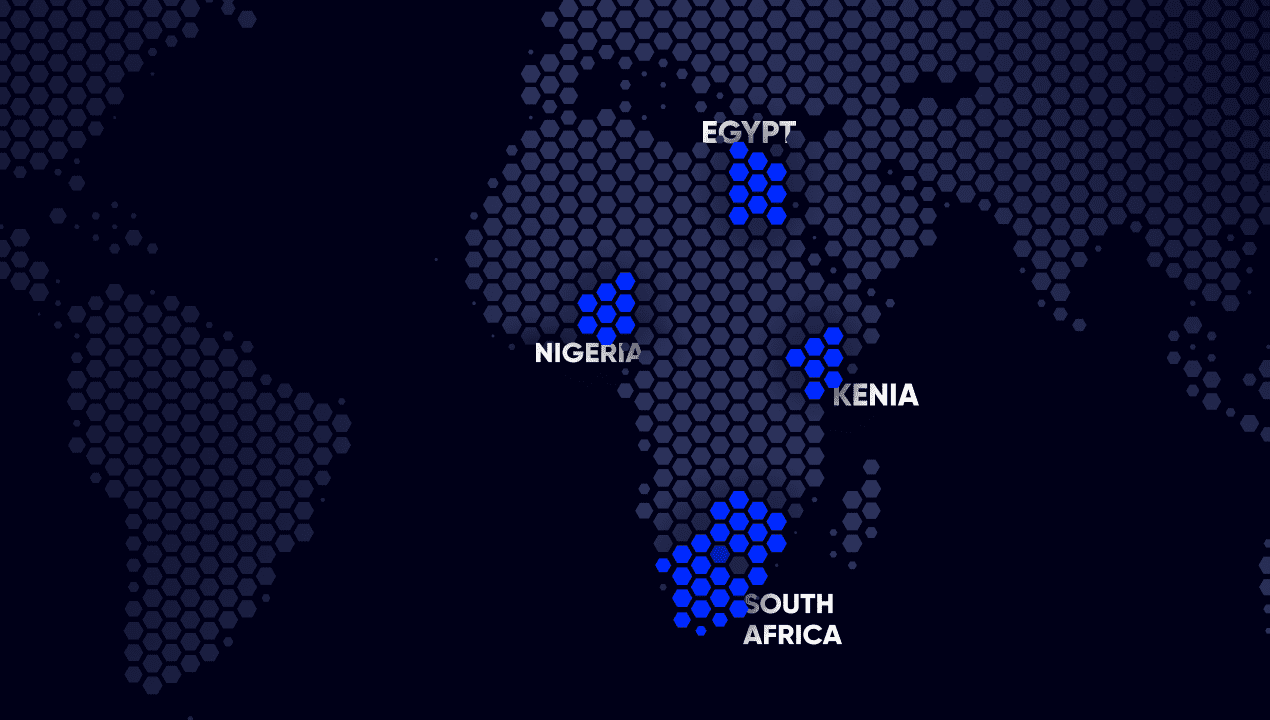

When our client, a bank in Kenya, released a new credit card, they needed to drive applications for this credit card, and hoped to do that with programmatic advertising. Our goal was to drive qualified leads.

We conducted upfront research to better understand the target audience, its online behavior, the bank customer journey, and which factors are likely to drive users to conversions. After that, our team developed a sophisticated advertising strategy aimed at reaching high-intent users who are more likely to be interested in the client’s service based on their online behavior. The campaign used a mix of behavioral, interest, demographic, contextual, and other targeting options. In order to grab and maintain users’ attention, we used banners and native ads, and to get conversions our team utilized search ads. Additionally, we set retargeting to interact with users who had already visited the client’s site but didn’t complete the target action.

Our AdOps and Data Analytics specialists were closely monitoring the process and the efficiency of the ad campaign to manually and automatically optimize it on time. During the campaign, the optimization was directed toward reaching a maximum number of high-intent users with relevant ads for them and driving conversions. Through artificial intelligence and machine learning algorithms, we were able to drive the efficiency of the client’s ads in real-time by redistributing budgets to audience segments, targeting options, ad creatives that showed better results, and turning off the less efficient ones.

Thus, we achieved the goal. Moreover, the client saw a 1.4x decrease in Cost Per Lead and got 264 applications for a new credit card.

If you need better results and increased profits with programmatic technology or just want to learn more about that, write by email info@nt.technology or just fill a form there.

Conclusion

Promoting financial services may be difficult, and finance brands may face a lot of challenges. The best way to overcome it and increase return on investment is to understand brand’s customers behavior and their intent and develop ad strategies based on this information. Technology can help to do that.

Other articles