Programmatic in Nigeria

- Author: Lizaveta Zhuk

When it comes to advertising in Nigeria, the share of digital ads has been increasing while technologies developing and the internet overtook other types of advertising. Despite the continued development of the market, digital ads is projected to continue growing at a steady pace in the coming years.

Digital Ad Market

Digitalization is step by step changing the Nigeria advertising market. Despite the traditional form of advertising continuing to be preferred, digital advertising starts to overtake them to take the first place in the media mix on the Nigeria market in the future. So investments in digital ads are constantly growing. Ad spending in the Digital Advertising market is projected to reach $179.20 million in 2022.

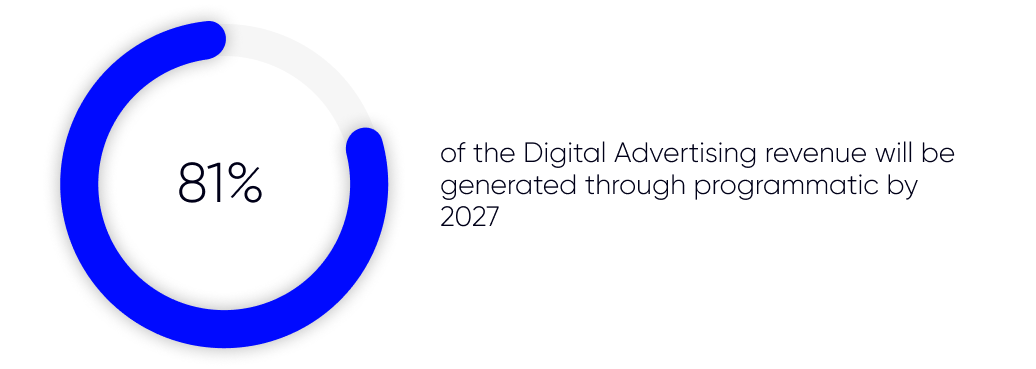

As technology and digitals skills improved, more brands switched their attention to programmatic advertising. In the Digital Advertising market, 72% of the Digital Advertising revenue will be generated through programmatic advertising in 2022.

Source: Statista

Available audience

There were 109.2 million internet users in January, which is equivalent to 51% of the total population. Despite the lack of internet connections, the number of internet users is growing slowly. Based on DataReportal research, it was increased by 4.6% between 2021 and 2022.

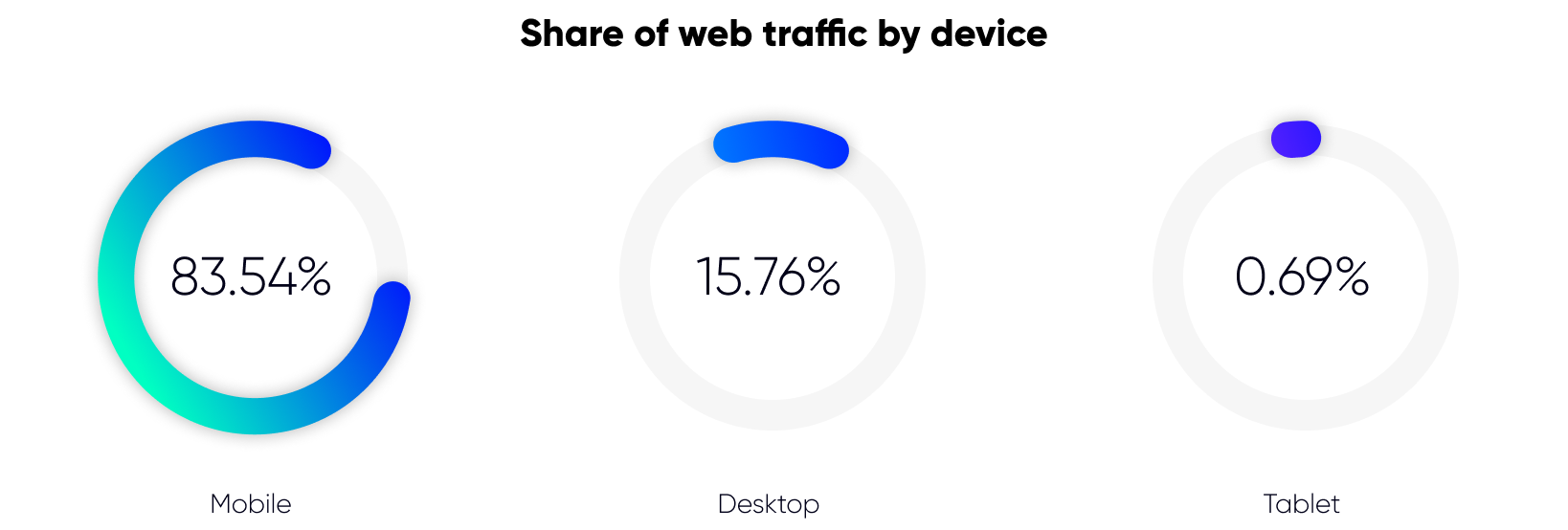

Data from GMSA Intelligence shows that there were 176.3 million cellular mobile connections in Nigeria at the start of 2022. It was equivalent to 82.4% of the total population. Despite the highest proliferation rate compared with desktop internet connections, the demand for mobile connections decreases. The number of internet connections decreased by 7.3% between 2021 and 2022. However, brands shouldn’t refuse to communicate with the target audiences on mobile devices. Smartphones are still the preferred device for surfing the Internet. Average users spend more than 5 hours a day using mobile internet.

Source: DataReportal

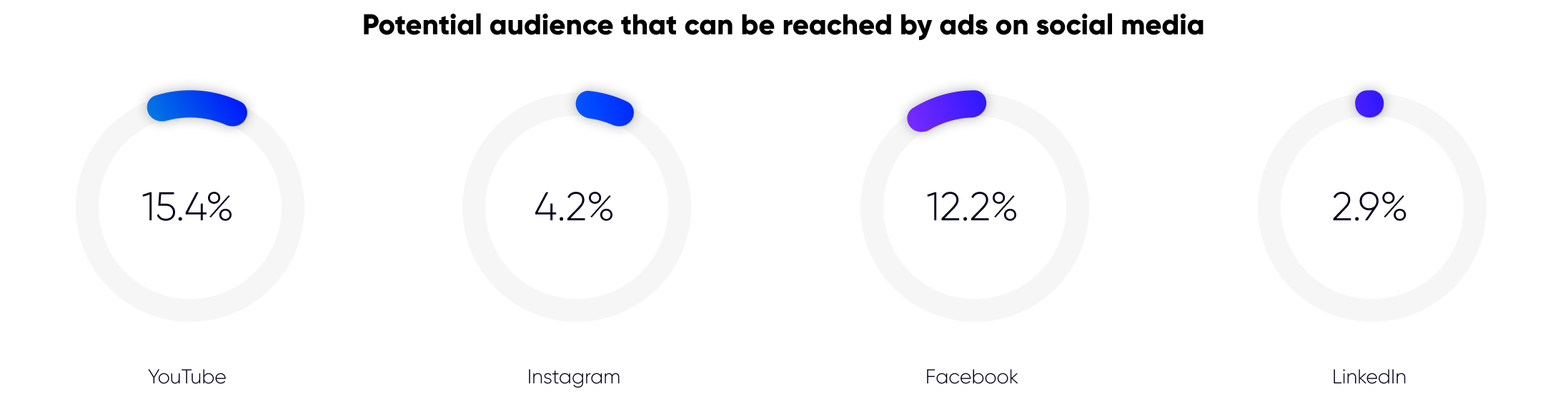

There were 32.90 million social media users in January 2022 that are equivalent to 15.4%. Users in Nigeria spent more at home in front of screens surfing the social media due to the pandemic. According to DataReportal, time spent using social media increased by 11.8% between 2021 and 2022. So it’s a good opportunity for brands to interact with the audiences on social networks, especially considering that 37.2% of users are using social media for finding content from brands and 35.7% of users are looking for things to buy.

Source: DataReportal

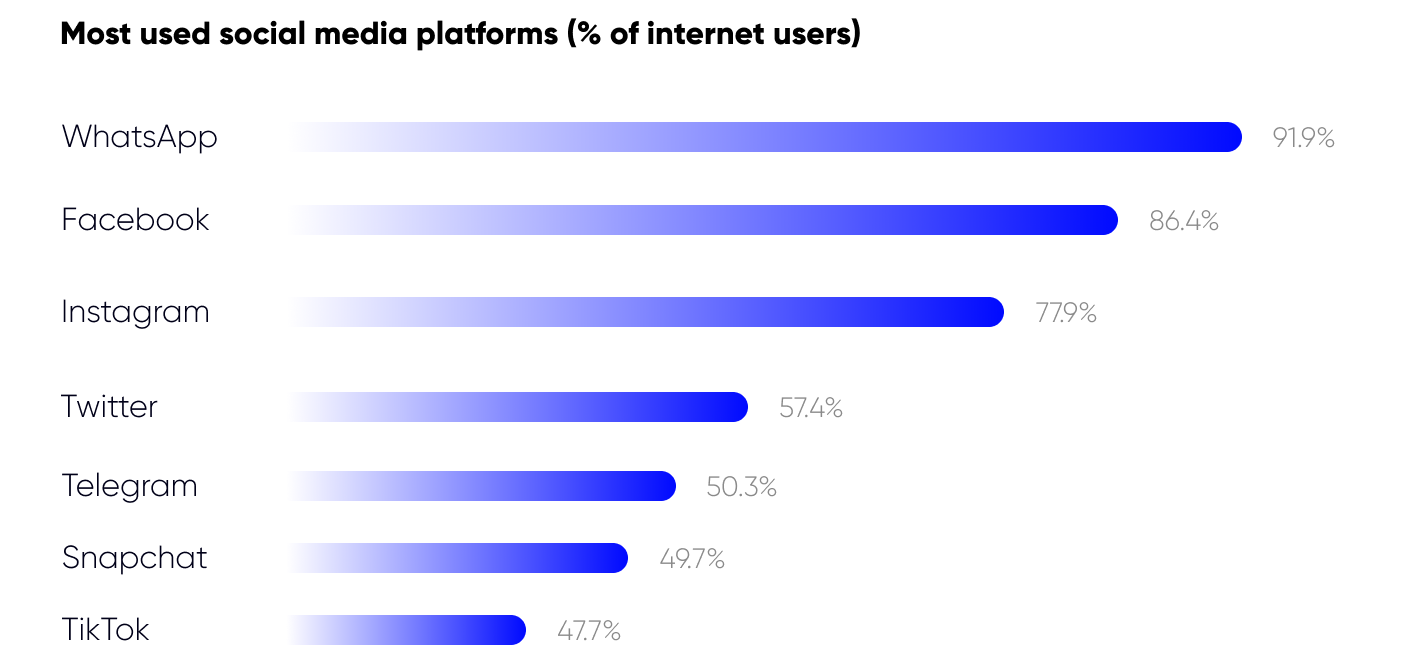

The most popular social networks are Facebook, Instagram and WhatsApp.

Source: DataReportal

Ad Formats

Considering that watching video is the preferred daily activity of users in Nigeria and 92.4% of users do that, no wonder that Video Advertising is the largest market’s segment with a market volume of $81.08 million in 2022.

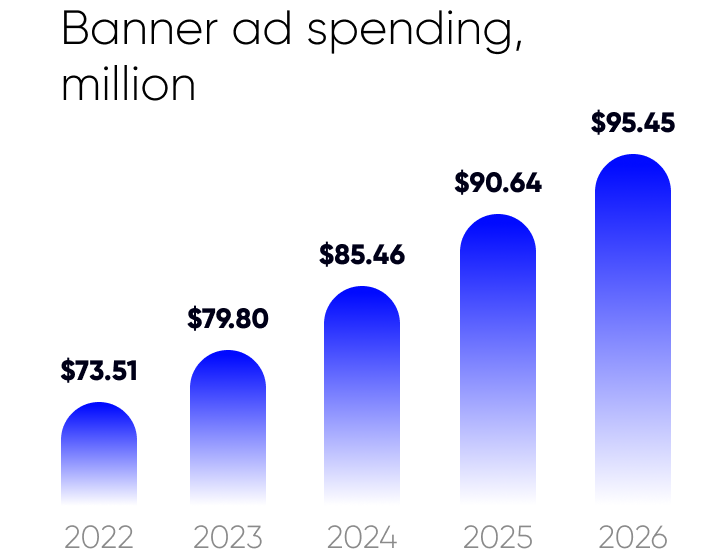

Banner advertising is growing as well. Nowadays, it is the second largest market’s segment with a market volume of $73.51 million in 2022. It is expected to continue increasing.

Source: Statista

One more trend in Nigeria’s digital advertising market is increasing investments in mobile advertising. It is expected that 69% of total ad spending will be generated through mobile in 2027.

Inventory

Top websites ranking

Google.com, Nairaland.com, Jumia.com.ng, Legit.ng, Punchng.com, Dailypost.ng, Vanguardngr.com, Gtbank.com, Lindaikejisblog.com, Jiji.ng

Top used SSP

- ADxAD

- Google Ad

- Mopub

- AdBook+

- MediaForce

- Adtelligent

- PX

- Adform

- OpenX

E-commerce market in Nigeria

Nigeria is the 33rd largest market for e-commerce with a revenue of $8.52 billion in 2022. Nigeria’s market is making a push towards digital channels for online selling through adoption of online payment services and increasing internet penetration rate. At present, a lot of brands in Nigeria use digital platforms increasing investments in online channels to interact with audiences and increase brands profit on e-commerce platforms. So the e-commerce market will continue to grow. Revenue is expected to grow annually by 13.86% between 2022 and 2025, resulting in a projected market volume of $12.58 billion by 2025.

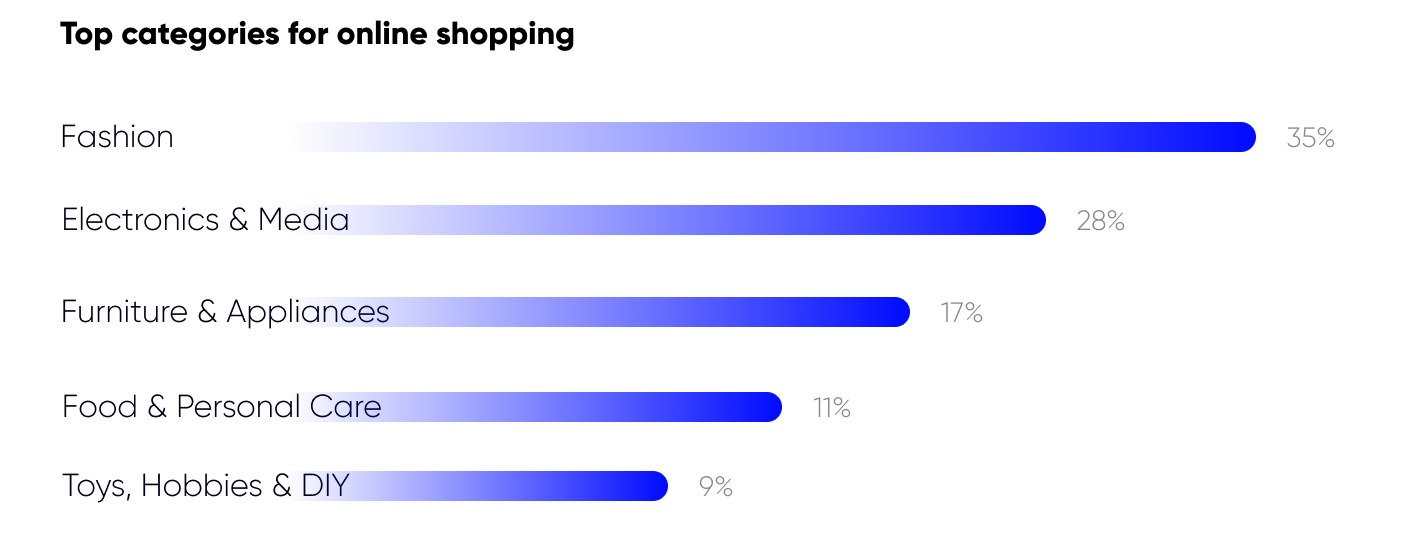

The COVID-19 pandemic accelerated adoption of online shopping among Nigeria users. So 48.9% of internet users in Nigeria make online purchases at least one time a week. The most popular category among online shoppers is Fashion, it accounts for 35% of the e-commerce revenue in Nigeria.

Source: ecommerceDB

Social media plays a significant role in users’ online behavior. They use social media not only for communicating with friends and being in touch with the latest events, they also research brands here. So for 79.2% of internet users in Nigeria social networks is the main channel for brand researching. So brands should consider that to develop an efficient marketing strategy. Programmatic advertising on social media can help to interact with e-commerce users at the right moment with the right messages.

Source: DataReportal

Market peculiarities

Nigeria is one of the largest advertising markets in Africa. A lot of brands change from regular TV and radio advertising to digital ads. So despite the lack of internet proliferation, programmatic and digital advertising is a fast rising industry on Nigeria’s market.

Read also

Read also