Programmatic in Singapore, Vietnam & Myanmar

- Author: Ksenia Soroka

The growth of Programmatic in Southeast Asia is increasing with a record-high rate. However, for Singapore, Vietnam and Myanmar programmatic is still quite a new field. Here are the main features and programmatic peculiarities of these countries.

Digital Ad Market

Programmatic spending in Southeast Asia is predicted to take up about 17 percent of total digital spending for 2019. However, as a result of increased scrutiny on viewability, ad fraud, and brand safety, lots of brands decreased their spending on Programmatic. Due to the fact that they feel underprepared for such unfavorable trends.

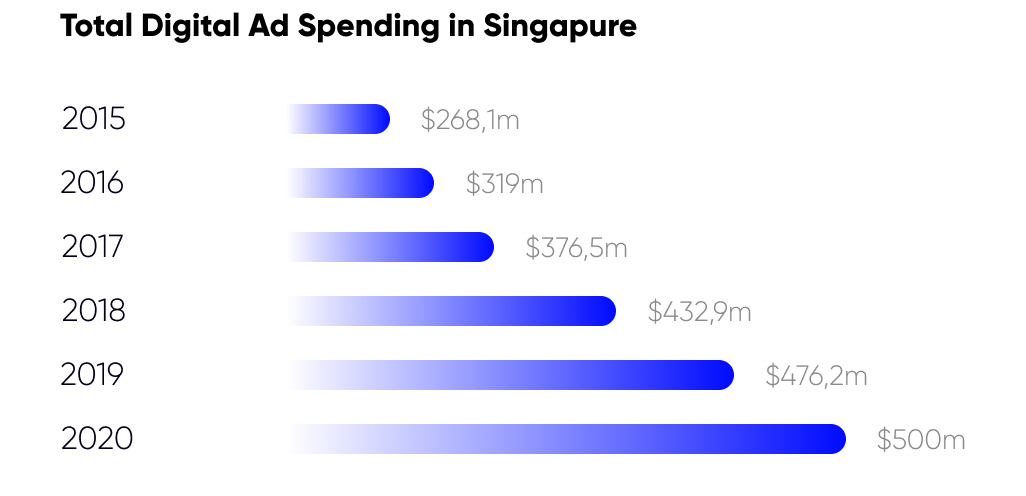

In general ad spending in Singapore is likely to be slow during the forecast horizon and it has been slowing down annually since 2015. By 2020, it is forecast that digital advertising will reach 30.8% of total advertising expense. Despite the fact that a lot of businesses in Singapore are aware of using Programmatic, 32% of brands invest more than half of their digital ads budget in this technology.

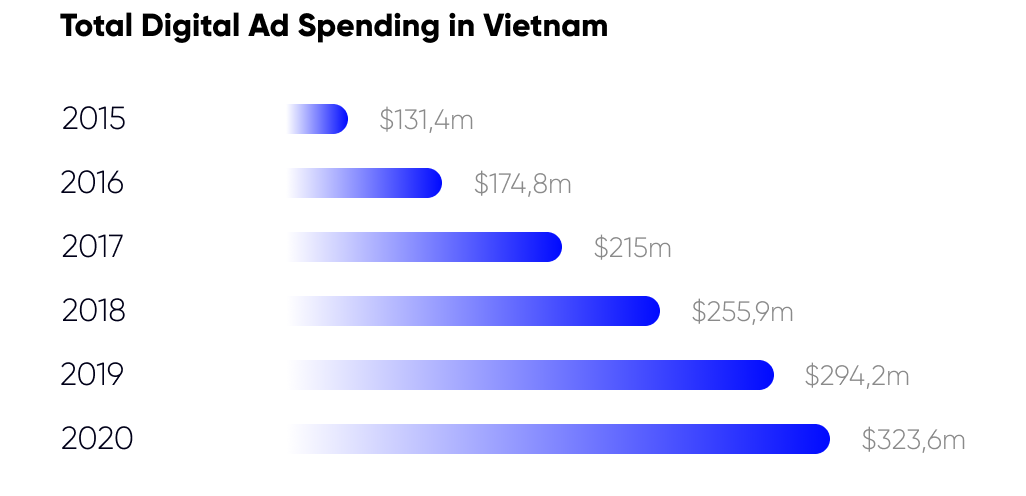

Digital ad spending especially mobile buying is increasing rapidly in Vietnam. 30% of the digital ad is purchased with the help of programmatic in Vietnam and its digital market increases annually. However, their share in Vietnamese total ad investment is not large enough. Moreover, the advertising market and programmatic applying in Vietnam currently aren’t as popular as in other Southeast Asia countries.

Advertising spending in Myanmar is shifting to programmatic and its becoming more and more popular. It’s growing quite fast and today, the advertising market is estimated at more than $200 million. However, the advertising industry in Myanmar can be assumed as being in its infancy. All this indicates that Myanmar is a mobile-only market.

Available Audience

Reach: 346. 11 million cookies

Impressions: 125. 47 billion

Ad Formats

These countries have one of the highest rates of smartphone use in the world and people prefer to use it for accessing the internet. According to this tendency, the mobile channel increases annually. For example, by 2020, mobile buying will account for about 90% of digital ads budget in Singapore.

Nowadays internet invasion rate in those countries is growing faster. Video is considered to be one of the most profitable formats for the last few years. By 2019, income made from programmatic video has reached 28% of all advertising costs.

Ad Inventory

Top Website Ranking:

Singapore:

google.com, youtube.com, facebook.com, instagram.com, wikipedia.org, google.com.sg, twitter.com, yahoo.com, reddit.com, staitstimes.com, live.com, channelnewsasia.com, baidu.com

Vietnam:

google.com, facebook.com, youtube.com, google.com.vn, 24h.com.vn, vnexpress.net, zing.vn, news.zing.vn, kenh14.vn, baomoi.com, xosodaiphat.com, dantri.com, shopee.vn

Myanmar:

google.com, youtube.com, facebook.com, myanmarload.com, channelmyanmar.org, openload.com, tinylink.run, google.com.mm, irrawaddy.com, popads.net, wikipedia.org, yahoo.com, upgers-armine.com, exosrv.com

Top SSPs used in Singapore, Vietnam, Myanmar:

- Indexexchange

- Appnexus

- PubMatic

- Openx

- AdForm

- AdOcean Global

- District m

- Contextweb

- Outbrain

- Tremorhub

- Teads

- Rubicon Project

- Gamma SSP

The Programmatic advertising market of Singapore, Vietnam, and Myanmar has seen development in recent years. Mobile devices promotion is one of the main factors that encourages the demand for programmatic ad, such kind of traffic shows high engagement rate in these countries. This market has prospects for development and also for expansion of Programmatic technology. However, it is expected that local advertisers of this market will contribute to the industry’s evolution in the near future.

Read also

Read also